STRATEGIES FOR CORPORATE OWNED LIFE INSURANCE (COLI)

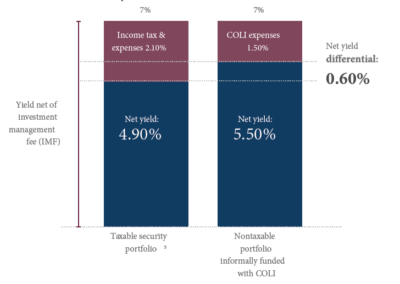

Clearpoint utilizes its experience to structure institutionally priced Corporate Insurance accounts sometimes known as “COLI”, to provide increased yield after tax on an investment portfolio for banks, insurance companies & individuals. We apply a systematic approach to the ongoing monitoring and improvement of employer-owned life insurance policies in all of its forms. We have experience in increasing the performance of these investments for mid-sized banks through product alternatives, and we provide market evaluation for clients looking to increase or decrease their position in this asset class. A big part of the experience and process is correlating a client investment philosophy to a specific money management allocation approach.

Leveraging Corporate Life Insurance is one key alternative that can be utilized to negate taxes on investment gains and risk-based capital charges. The following is an overview of corporate life insurance as an efficient vehicle to accomplish this value proposition.

What Is ICOLI?

COLI is a general term for Corporate Owned Life Insurance. “I” COLI is simply life insurance owned by an insurer.

-

ICOLI is purchased by insurers for a variety of corporate reasons

- Investment wrapper for invested assets, plus

- Optional life insurance benefit for insured employees

- Funding source for a given liability/expense

-

Advantages of utilizing ICOLI as an investment wrapper

- Wrapper. Wraps almost any asset class

- Returns. Enhances after-tax returns

- RBC. Reduces risk-based-capital charges

- Optics. Improves balance sheet optics

Why Do Insurance Companies Purchase ICOLI?

Institutional Pricing

- Products are designed for institutional purchasers, with high early cash values and low, stable cost structures

- Immediate, positive impact to earning; no front-end loads or surrender charges

Tax-Efficient Accounting

- Gains in contracts are tax deferred

- If policies are held to maturity (death of the insured), gains plus death proceeds are received tax free

- Rebalance and trading activity does not trigger taxation

- $1 of premium can create $3 of tax benefits and tax-free proceeds

Advantages Risk Factor

- In accordance with SSAP 21(6) ICOLI is considered an admitted asset. Under current guidance from SSAP 21 there is no NAIC RBC charge on cash surrender value life insurance, regardless of underlying asset allocation.

- AM best – consistent with NAIC treatment, may apply a BCAR charge of 0.8%reflecting the credit quality the insurance carrier issuer.

Book Value Accounting and Volatility Stabilization

- General account life insurance provides stable, predictable yields

- Volatility reducing ‘’wraps‘’ can allow book value accounting on marked – to – market assets in variable universal life insurance contracts

Customized Investments

- A wide variety of traditional investments are available

- Investments or investment managers can be added by the purchaser, subject to minimum initial investments

- Private equity and real estate is available subject to minimums

Enhanced Benefit Program

- Insurance company can enhance their executive’s benefit package through an arrangement to share the death benefit

Market Prevalence: Top 60 ICOLI Holders

The following list includes carriers taking billions in a COLI position.

Cash surrender value of ICOLI as reported in their statutory financial statements. (Figures are in $000s)

Data supplied 12/31/2021

| Insured | Amount | |

| New York Life | $ | 4,694,128,000.00 |

| MetLife | $ | 3,146,634,000.00 |

| MassMutual | $ | 2,879,983,000.00 |

| Nationwide | $ | 1,815,987,000.00 |

| Principal Financial Group Inc. | $ | 1,615,076,000.00 |

| John Hancock | $ | 1,374,138,000.00 |

| Sammons Enterprises Inc. | $ | 1,300,480,000.00 |

| Lincoln Financial | $ | 1,221,093,000.00 |

| Anthem Inc. | $ | 1,039,877,000.00 |

| Equitable Holdings | $ | 999,376,000.00 |

| Liberty Mutual | $ | 941,584,000.00 |

| Northwestern Mutual | $ | 910,399,000.00 |

| Farmers Insurance | $ | 725,996,000.00 |

| Protective | $ | 723,201,000.00 |

| Allianz | $ | 713,447,000.00 |

| Mutual of Omaha | $ | 712,943,000.00 |

| The Hartford | $ | 595,788,000.00 |

| NLV Financial Corp. | $ | 562,689,000.00 |

| Transamerica | $ | 553,875,000.00 |

| Unum Group | $ | 518,104,000.00 |

| OneAmerica | $ | 496,827,000.00 |

| Chubb | $ | 482,104,000.00 |

| Arch Capital | $ | 460,177,000.00 |

| American Equity | $ | 384,254,000.00 |

| GuideWell | $ | 381,819,000.00 |

| Athene U.S. only | $ | 378,713,000.00 |

| Westfield Insurance | $ | 329,447,000.00 |

| Kemper | $ | 327,258,000.00 |

| Great-West U.S. only | $ | 315,419,000.00 |

| Fidelity & Guaranty Life | $ | 299,438,000.00 |

| Penn Mutual | $ | 298,516,000.00 |

| CNO Financial Group | $ | 269,094,000.00 |

| Americo | $ | 255,288,000.00 |

| RGA U.S. only | $ | 254,245,000.00 |

| Pacific Life | $ | 209,598,000.00 |

| Great American Insurance | $ | 196,874,000.00 |

| Travelers | $ | 194,530,000.00 |

| National Guardian Life Ins Co | $ | 151,029,000.00 |

| Highmark | $ | 150,380,000.00 |

| FM Global | $ | 131,233,000.00 |

| Kemper | $ | 120,830,000.00 |

| RiverSource | $ | 116,603,000.00 |

| Zurich | $ | 114,975,000.00 |

| Allstate Corp | $ | 113,259,000.00 |

| Amica | $ | 111,152,000.00 |

| KUVARE | $ | 99,702,000.00 |

| CUNA Mutual | $ | 99,019,000.00 |

| ProAssurance Corp. | $ | 86,809,000.00 |

| EMC Insurance | $ | 81,778,000.00 |

| Globe Life Inc. | $ | 80,343,000.00 |

| Security Benefit | $ | 76,168,000.00 |

| Sentry | $ | 74,645,000.00 |

| American Fidelity | $ | 74,520,000.00 |

| Michigan Farm Bureau | $ | 71,379,000.00 |

| Ameritas | $ | 70,979,000.00 |

| Southern Farm Bureau Life Ins | $ | 68,187,000.00 |

| Tennessee Farmers Life Ins Co. | $ | 66,561,000.00 |

| BlueCross BlueShield of TN | $ | 66,374,000.00 |

| West Bend Mutual Insurance Co. | $ | 64,308,000.00 |

| Mutual of Enumclaw | $ | 62,612,000.00 |